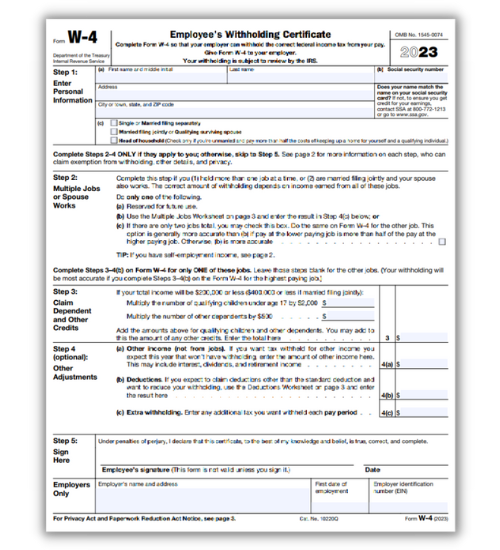

Filling Printable IRS W-4 Form Effortlessly

The IRS W-4 form is a document completed by employees in the United States to indicate their tax withholding status to their employer. Employers use the form to determine how much money to withhold from an employee's paycheck for federal income taxes. Taxpayers must complete this federal form accurately to avoid overpaying taxes throughout the year.

The website w4-form-printable.us is a valuable resource for filling out the blank W-4 tax form. The website provides a printable version of the blank federal form and detailed Form W-4 instructions and explanations for each section. By utilizing the materials on this website, individuals can ensure that they accurately complete the federal W-4 form by IRS and avoid any potential tax issues.

Terms to File the IRS Form W4 in 2023

Employees use Form W-4 to let their employer know how much federal income tax to withhold from their paychecks. You must fill in and file a Form W-4 with your employer if you are starting a new job or if there are changes to your tax withholding status. For example, if you get married or have a child, you may need to adjust your withholding by submitting a new Form W-4. The IRS provides a printable W-4 form for 2023 on its website, which you can complete by hand and give to your employer, or you can fill out the form online and print out a copy to give to your employer. There is also a blank sample of the W-4 form available for reference and instructions on how to print the W-4 form in 2023 and fill it out.

Exemptions for Filing Form W-4

-

![Non-resident alien status]() Non-resident alien statusIf an individual is a non-resident alien for tax purposes, they are not required to fill out and file a Form W-4 with their employer.

Non-resident alien statusIf an individual is a non-resident alien for tax purposes, they are not required to fill out and file a Form W-4 with their employer. -

![Exempt from withholding]() Exempt from withholdingIndividuals may claim an exemption if they had no tax liability the previous year and expect no tax liability for the current year.

Exempt from withholdingIndividuals may claim an exemption if they had no tax liability the previous year and expect no tax liability for the current year. -

![Multiple jobs]() Multiple jobsIf an individual has multiple jobs and their combined income exceeds the standard deduction, they can claim an exemption for one of the jobs.

Multiple jobsIf an individual has multiple jobs and their combined income exceeds the standard deduction, they can claim an exemption for one of the jobs.

Filling Guide for Printable Blank W-4 Form

To avoid mistakes when filling out federal tax withholding form W-4, it is essential to read and follow the instructions provided by the IRS. It's important to double-check your information before submitting the form. If you're unsure about filling out a certain section, consult the instructions or seek advice from a tax professional.

Step-by-step guide on how to fill out the federal W-4 form in 2023:

- Obtain a printable Form W-4 PDF

You can obtain a copy of Form W-4 by visiting the IRS website, where you will find a the current version in PDF, as well as fillable template so you can fill out online and then print the W-4 form for free. - Read the instructions

Before filling out the form, read the instructions provided by the IRS. These instructions will help you understand how to fill out the form correctly and avoid any mistakes.

- Personal information

In Box 1, enter your name and address. In Box 2, enter your social security number. - Marital status

In Box 3, indicate your marital status by checking the appropriate box. - Allowances

In Box 4, enter the number of allowances you are claiming. You can use the worksheet provided in the instructions to help you determine the number of allowances to claim. - Additional withholding

In Box 5, enter any additional amount you want to be withheld from each paycheck. - Sign and date

Sign and date the form in Box 6. - Submit the form

Give the completed form to your employer.

Note that if you have the W4 form to fill out online, you will follow the same steps, but instead of manually filling out the form, you will be prompted to fill in the information online and print it out.

IRS Penalties

Individuals may face penalties from the IRS if they fail to submit Form W-4 properly. Penalties can include failure to furnish the W-4 tax form printable, furnishing incorrect information, furnishing it on time, claiming the correct number of allowances, claiming exemptions, or making false statements. The penalties can range from fines to a percentage of taxes owed, depending on the infraction. It's important to note that these penalties are avoidable by filling out the form correctly and on time.

File Now

Popular IRS Form W-4 Questions With Examples

- Can I submit a W-4 form electronically?The IRS does not currently offer an electronic version of the W-4 form for employees to fill out and submit. However, some employers may have an electronic system for employees to submit their W-4 forms. It's best to check with your employer to see if this option is available.

- Can I change my W-4 form during the year?Yes, you can change your W-4 form during the year if your personal or financial situation changes. It's important to inform your employer of the changes, so they can adjust the amount of federal income tax withheld from your paycheck accordingly.

- What happens if I don't submit a W-4 form?If an employee does not submit a W-4 form, the employer will use the information on file for the employee or will withhold taxes as if the employee is single and claiming no allowances. This could result in the employee owing a large amount of taxes at the end of the current year or receiving a smaller refund.

- What are the penalties for not withholding enough taxes on the IRS W-4 form in 2023?Employees who do not withhold enough taxes on their W-4 form may be subject to penalties and interest charges from the IRS. The employee may also owe taxes at the year's end. Reviewing and updating your W-4 form regularly is essential to ensure the correct amount of taxes is withheld.

- Can I claim more than one job on my W-4 form?Yes, if you have more than one job and your combined income will push you into a higher tax bracket, you can claim multiple jobs on your printable W-4 form. This will increase the amount of taxes withheld from your paychecks, which can help prevent owing taxes at the end of the year. It's best to consult with a tax professional to ensure that the proper number of allowances are claimed.

Additional Materials About Form W-4

Filing Federal W-4 Form: Conditions for Different States The W-4 form is a document used by employees to determine the amount of federal income tax that should be withheld from their paychecks. It is important for employees to accurately fill out and file this form, as it can significantly impact their taxes at the end of the year. The process of filling...

Filing Federal W-4 Form: Conditions for Different States The W-4 form is a document used by employees to determine the amount of federal income tax that should be withheld from their paychecks. It is important for employees to accurately fill out and file this form, as it can significantly impact their taxes at the end of the year. The process of filling... - 12 January, 2023

- Alternatives to the IRS W-4 Form The W-4 form is an important document used by employees to determine the amount of federal income tax that should be withheld from their paychecks. The form is completed and submitted to the employer, who then uses the information to calculate the appropriate amount of tax to be withheld from the em...

- 11 January, 2023

- All About Printable W-4 Form The W-4 form is an essential document that employees must fill out to determine the amount of federal income tax that should be withheld from their paychecks. While many people choose to complete the form online, there are still many advantages to using the printable version. Advantages of the prin...

- 10 January, 2023

Print the W-4 Form for Free

Get FormPlease Note

This website (w4-form-printable.us) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.